President Trump’s tariffs are once again dominating the news cycle in the wake of the latest court decision to try and stop his election promises. This time it is by the previously unheard of, U.S. Court of International Trade. Top economic advisor, Kevin Hassett, expressed the day after that

the Administration was confident this ruling is incorrect and will be overturned. Later that same day, the U.S. Court of Appeals for the Federal Circuit gave a temporary stay until at least June 9th.

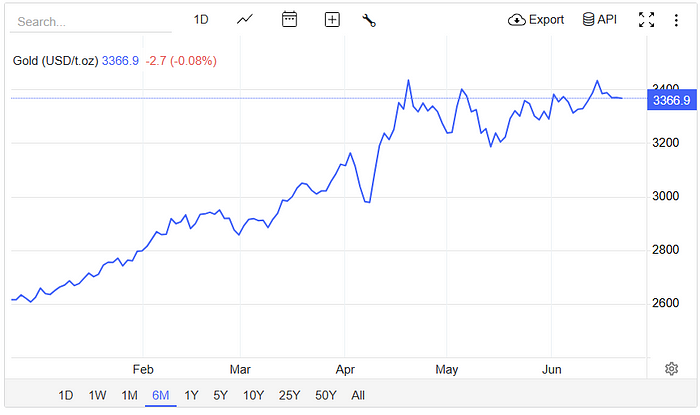

Gold reacted by increasing 2% in price, from the original court’s verdict on May 28th to Hassett’s statement the next day on the 29 th . Over the past two months, the price of gold has looked somewhat schizophrenic at times, particularly in relation to tariffs. It dropped more than 6% in the week after “Liberation Day”, then climbed back almost 17% during the first two weeks of the “Art of the Deal” pause. It has been a roller coaster ride since, but within a somewhat flatter trend.

Unless you are a professional, or even amateur, trader, it is best to look at gold investment with a perspective of years or decades, rather than just days, weeks or even months. In the shorter term, gold price is driven by what economist John Maynard Keynes called “animal spirits.” In the longer term, it is driven by “monetary spirits.” And not just as protection, but also for performance. The new 2025 Presidential Gold Guide highlights both these in Chapters 5 and 4, respectively.

Economist and investor Mark Skousen wisely noted that: “Since we left the gold standard in 1971, both gold and silver have become superior inflation hedges.” And the numbers back that up. Gold has more than countered the results of inflation, as somewhat measured by CPI (Consumer Price Index), and the drivers of inflation, as considerably measured by M3 (money and credit supply).